Balloon mortgage loans was yet another station for ambitious residents. Balloon mortgage loans are whenever an enormous portion of the lent idea was repaid in one percentage at the conclusion of the brand new mortgage months. Balloon loans aren’t preferred for some residential consumers, but are more widespread getting commercial funds and people with high economic possessions.

Talking about mortgage loans where payments is used just to interest having an occasion. The new loan’s dominant isn’t really repaid, and so the monthly payments are extremely lowest. The reduced monthly premiums just lasts many years, however. Generally speaking, it is more about 36 months. After this several months, monthly obligations spike given that loan’s principal wasn’t reduced & the rest of the loan must be repaid within the a great compressed period of time. For example, to the an effective step 3 season IO 31-season financing, the original 3 years are appeal merely costs, then your loan dominant should be paid in full regarding the subsequent twenty seven many years.

Whenever being qualified for a loan, a credit score out-of 720 or most useful will help secure good beneficial financing. Certain lenders provides recognized individuals with credit scores to 640. An informed prices and you can revenue could be gotten that have a score more than 740. There is a lot out-of battle certainly lenders, and that environment can make nice advantages getting borrowers. Like, some financial institutions will give promotions towards the closing costs having individuals just who be considered. The price is added to the mortgage or perhaps the financial will pay this new closing costs however, add a number of base affairs towards the Apr.

A loans-to-earnings ratio of forty% and you can an advance payment of 20% are what really banking institutions want to see into the home financing application. They’re going to deal with worse numbers personal loans for bad credit CO, however, fees and you can APR’s could go up as a result. Along with, a down-payment regarding lower than 20% typically leads to expected financial insurance. It deposit demands cannot make an application for Federal guidance software eg FHA, in which people may have less credit history and money but nevertheless receive financing.

This new piggyback financing is yet another particular financial that is merely two mortgage loans in a single. The latest piggyback loan normally take away the need for individual home loan insurance rates of the covering 80% of one’s home’s value to your very first mortgage, because second financing helps buy a portion of the advance payment.

Federal Guidance Applications

Prospective homebuyers that simply don’t pick what they’re looking for from the one of many nation’s personal financial institutions may prefer to take a see a number of the financial solutions the us government also provides. Included in this ‘s the mortgage system at the Veterans Management, which provides mortgage loans with zero down. Simultaneously great deal, Va funds none of them personal mortgage insurance coverage. The institution do, but not, charge a financing commission, which varies from 1.2% to three.3%. And come up with a voluntary advance payment wil dramatically reduce so it fees. Incase you might be wanting to know, sure you actually have to-be an experienced seasoned to track down one of these unbeatable marketing.

Bodies Programs

If you aren’t a vet, you can look at the Government Homes Administration’s home loan services. The new FHA offers fund to people that a credit rating with a minimum of 580 and you may that will place at the least step three.5% down. The us government company even offers mortgages having down credit ratings, but it means extra money down with the financing.

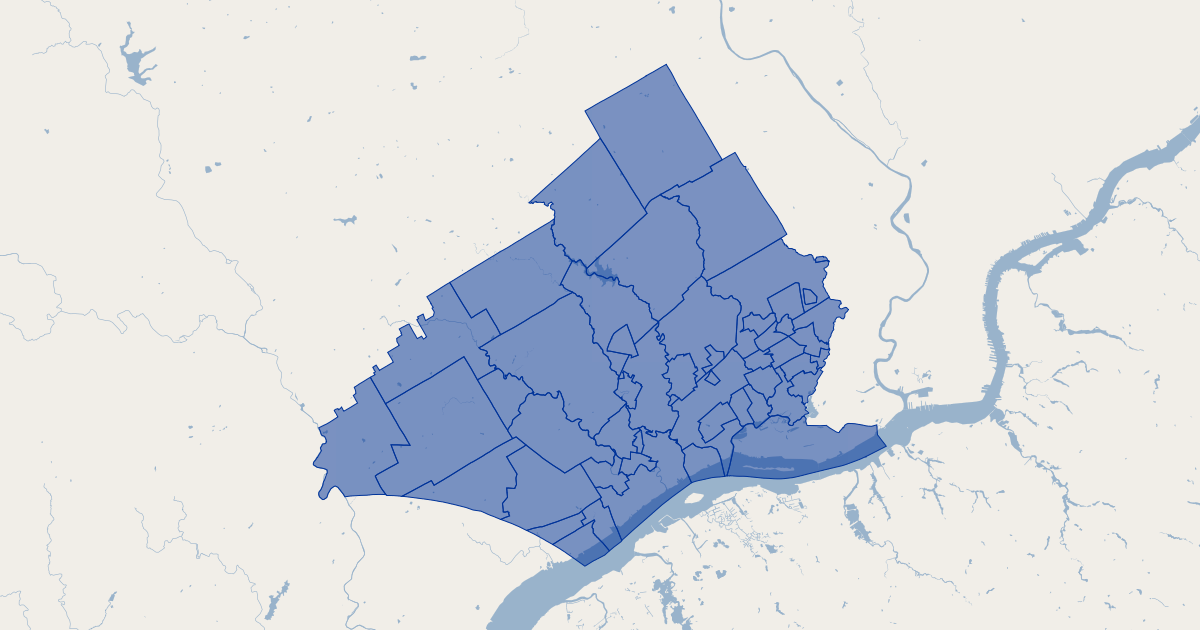

USDA money will help people with low income in the outlying bits of the condition qualify for a good sponsored low-desire loan. Because of the reduced people density throughout all state, most portion qualify.