Leverage the home’s equity to improve earnings and enjoy the advancing years you usually dreamt off. At the Elder Financing, you can expect Family Equity Conversion process Mortgages (HECMs) guidance, offering people the new independence and you can depend on to call home their particular terminology.

HECM means Household Equity Conversion process Financial. Its a sensible kind of household guarantee personal line of credit geared toward providing old age-old home owners acquire finest command over the fees of its mortgage.

Essentially, a house Security Conversion Mortgage enables you to withdraw a portion of your house’s security, so it is a financially-feasible opportinity for visitors to enhance their old age finance. With a keen HECM, you keep complete ownership of your house exactly as you would which have a classic home loan. Yet not, a keen HECM has some pros perhaps not introduce which have a traditional financial.

Preferred Making use of The HECM

When you’re over 62 and you may very own the majority of your household, you will likely be eligible for an enthusiastic HECM financing during the Fl. For the independence, you’ll find loads from methods use your dollars so you can service lifetime:

- Cover health care costs

- Consolidate or pay personal debt

- Maintain daily living expenses

- Renovate your house

- Render heirs with a genetics

- Complement your earnings

- Setup senior-amicable household adjustment

- Progress inheritance currency on the heirs

Great things about HECMs

A good HECM is one of the most preferred variety of reverse mortgage loans insured by the Government Homes Administration (FHA). Permits older people to alter area of the collateral in their house towards the liquids cash they’re able to used to supplement its later years money, purchase problems otherwise address any other section of its existence. Making use of a beneficial home’s well worth using an enthusiastic HECM has the benefit of some body of numerous masters, including:

Quick access so you’re able to Bucks

HECMs give different methods to get your hands on your money, in addition to lump sum, term percentage or line of credit channels. Any strategy you decide on, you should have the fresh versatility to make use of your bank account however you see match.

Look after Overall Owning a home

That it mortgage allows you to keep complete ownership more your property on term unless you get-out otherwise sell. You should nevertheless shell out your home fees and you may homeowners insurance when you’re maintaining the property.

Treat Monthly obligations

The latest HECM financing discusses your whole established home loan, thus you might never have to worry about costs once again. Once the financing is not due until you get-out, it will not wanted almost any monthly payment, in the event individuals can be opt to submit repayments into interest otherwise principal if wanted.

Enjoy Later years Security

The cash you get away from good HECM loan is free of charge to have fun with but you would you like to. Which have a handy cash flow, you’ll end up liberated to handle jobs such as making house solutions otherwise paying off their personal credit card debt.

Why you should Choose Older Lending?

On Elderly Credit, we help you maximize your later years. We get this to you’ll be able to by providing the Florida residents HECM reverse mortgage loans they’re able to faith giving them the fresh freedom they need.

All of us might have been serious about it purpose for over twenty-five years and you can centers on getting a romance-motivated provider you to propels you towards your financial specifications.

All of our solution try backed by a devoted party away from industry experts and you will gurus who proceed through faithful studies attain the info needed to find the best system for your requirements. Handling our positives will give you the brand new reassurance out of understanding debt coming is secure.

We’re going to couples you having a personal advisor prepared to tune in to the details of one’s situation. They are by your side out-of appointment to help you closing, ensuring you can access a professional source of guidance.

The fresh HECM App Processes

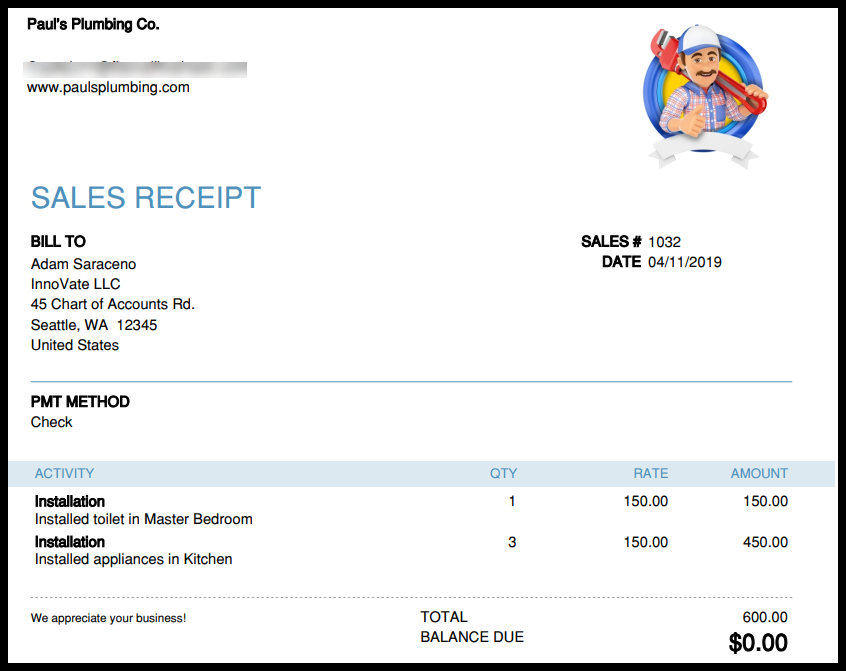

The entire procedure requires between 30 to help you 45 weeks so you can complete and requirements several other procedures to get your hands to the bucks you prefer.

Counseling

Residents need done a guidance session performed from the an excellent federally insured service. You will then see regarding loan’s benefits, qualification standards, associated costs and. It meeting assurances you understand the fresh ins and outs of the fresh mortgage and gives your count on for making the proper choice to own your position.

Application

Since your reverse mortgage merchant, we’re going to need some certain suggestions so you can accept their HECM financing. A number of this post is sold with your income, possessions, expenses and credit score. The HECM mentor will help you to collect the required documents and you can complete the application to make a fuss-totally free procedure.

Assessment

Having your domestic appraised is a vital step in the method out of protecting your own reverse mortgage. At that action, a specialist appraiser tend to evaluate your residence’s worth, deciding on market price, area, size and you may condition.

Underwriting

Together with your appraisal statement available, brand new underwriter becomes to function to examine your application. You’ll then found the loan recognition, which means that you may be prepared to start with brand new closing process.

Closing

Closure and you can money is the history step in the latest HECM procedure. An ending broker have a tendency to visit your house with the borrowed funds closing records, therefore it is simple to approve the loan and discovered the finance. This phase is additionally when you can like how exactly to accessibility your own cash.