It is not too difficult so you’re able to pre-shell out a personal bank loan otherwise car loan compared to the a great home loan once the amount borrowed might be much smaller

Comprehend the benefits of area payment and you can pre-closing of financing. Decrease your appeal outflow and you may reach monetary freedom having early installment.

Once we start working and place from our own, you will find some occasions where it generates best inexpensive feel so you can borrow money. Such as for instance, if you need to install property, as you you’ll rent a condo and purchase the fresh new rent from your normal earnings, you might see it a great deal more practical to get a home having the assistance of financing. This way the cash used on lease you may today be taken to pay for the fresh new EMI. For this reason, what might was basically an expenditure was turned a keen financing.

Whatever the sort of loan one to takes – if or not a mortgage, a car loan if not a consumer loan, one should pay an interest. The audience is ergo always on the lookout for ways and means to repay the borrowed funds within basic and reduce the attention.

There are two ways that you can slow down the complete attention outflow – area commission otherwise pre-closure. Pre-closing is also also called prepayment out-of financing. On this page we mention in more detail exactly what region commission and you may pre-closure/prepayment regarding loans requires therefore the benefits to the fresh debtor.

Yet not, regarding lenders, this may be more challenging. But not, any time you come into a substantial amount of money, you could potentially take into account the accessibility to part-commission of the amount borrowed. In this circumstances, you have to pay a portion of your a good dominating amount more and you can over the existing EMI. Through the elimination of the main matter, your slow down the complete desire count that might be recharged to help you you otherwise. Exactly like prepayment of funds, really loan providers tend to levy a punishment or part-percentage charges toward signature loans. In the case of home loans loans Andalusia, some loan providers waive so it charge.

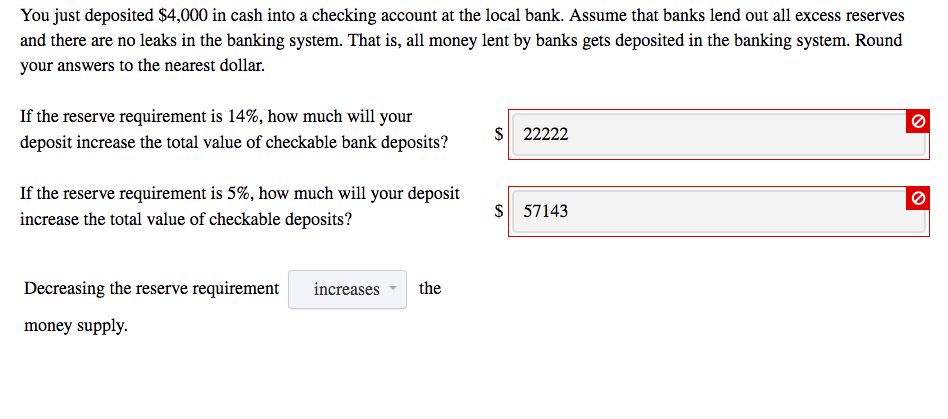

The dining table less than will allow you to understand how a member fee makes it possible to build an overall total protecting. They takes on you have an excellent loan amount out of INR 500,000/- and get INR 100,000/- getting a member-repayment. In addition assumes on you to people saving inside the EMIs try invested % per annum.

According to this type of metrics, from the partially paying INR 100,000/- of one’s mortgage, your might gain INR 26,264/- at the conclusion of the five-year period. These numbers vary if for example the interest on the mortgage, interest rate getting financial support, financing punishment fees or other activities change.

Prepayment From Financing: A great prepayment out of financing occurs when you close a loan very early if you are paying the complete an excellent prominent and you will appeal on loan all at once

It is therefore vital that you comprehend the monetary benefit to on your own if you opt to pre-personal a loan or decide for a member-installment just after looking at penalties or any other charge. In the example of lenders, its also wise to bear in mind the fresh income tax promotion work with offered as much as INR 150,000/- of one’s prominent number whenever you are starting this new calculation.

Zaroorat aapki. Consumer loan Humara

Disclaimer: Every piece of information within article is for general advice aim merely. IIFL Financing Restricted (along with their associates and you will associates) (“the firm”) assumes on zero liability or duty when it comes to problems otherwise omissions during the the brand new items in this information and you may for no reason shall brand new Business end up being accountable for people ruin, loss, burns otherwise frustration etc. sustained because of the one reader. All recommendations in this article is provided “as well as”, with no verify out-of completeness, accuracy, timeliness otherwise of your own show an such like. taken from making use of this information, and you may in place of guarantee of any kind, share or created, and, although not limited to warranties out of results, merchantability and you can physical fitness to own a particular objective. Because of the switching characteristics from statutes, rules and regulations, there can be waits, omissions or inaccuracies in the information in this post. What on this subject article is provided with the brand new with the knowledge that the firm isnt herein involved with helping to make legal, bookkeeping, income tax, or any other qualified advice and you can features. As a result, it has to not used as a replacement to possess consultation that have elite group bookkeeping, taxation, judge and other competent advisors. This short article can get consist of viewpoints and you may views being the ones from the fresh new experts and don’t fundamentally mirror the official policy or status of every most other company otherwise team. This post can also contain links so you’re able to external other sites that will be not made otherwise handled by the or perhaps in in whatever way associated with the business while the Team will not guarantee the accuracy, benefits, timeliness, otherwise completeness of any information regarding this type of external websites. Any/ all of the (Gold/ Personal/ Business) financing product specifications and you can suggestions you to definitely perhaps stated in this informative article try susceptible to go from every now and then, subscribers are encouraged to get in touch with the firm to own newest demands of told you (Gold/ Personal/ Business) mortgage.