- Home loan Articles

- Problems To cease Before applying To possess Home loan

Guess what youre supposed to would prior to taking one step to the trying to get home financing look into the home prices, save having in initial deposit. The things avoid being starting, not, was barely talked about.

You might improve your likelihood of having the household you want by avoiding the fresh mistakes that may reduce the number of investment you could potentially receive, boost the interest rate on the home loan, otherwise direct a lender to deny the application.

We are going to let you inside the into the half a dozen biggest errors our Advantages state you really need to eliminate while planning to get home financing.

Changing Efforts

A lender has to be assured you have a steady income and you can bear to fund a home loan installment bill monthly. Therefore about two years off constant a position considerably enhances the mortgage application. Likewise, your chances of qualifying for home financing try jeopardized once you option services before implementing. Of all things don’t be doing prior to preparing the financial software, switching perform is near the top of record.

Skipping Statement Payments

Their commission background usually accounts for thirty five% of the complete credit score. It indicates actually one to later percentage is enough to bring your get off from the fifty products or higher sufficient to cost you your house you desire.

Loan providers seriously consider the credit scores of candidates. Run enhancing your rating and maintaining it before you apply to suit your mortgage.

While making Big Sales

To get an automobile, a fridge otherwise people major item is not necessarily the top flow before applying to possess a mortgage. With genuine savings is amongst the first something loan providers want away from individuals and to make a major pick can cut into your cash on hand. Taking out fully a loan otherwise using your bank card to make a purchase was an even bigger red-flag in order to a loan provider.

Stacking Right up Bills

Taking up numerous expense before you apply to have a mortgage often enhance your loans-to-money online payday loans Sedalia Colorado ratio, that is the full personal debt, like the prospective home loan, divided by simply how much you have made per year. The greater the DTI, the low your odds of a lender approving the loan.

When you have a DTI out-of six or more complete obligations no less than half a dozen moments their annual earnings loan providers tend to believe your a dangerous debtor.

Closing Down A credit card Account

In many facts, closing a card-cards membership try a smart flow however when you require to apply for a home loan.

Should you get gone a credit card, your own level of offered credit is less. This will damage your credit score, since your loans-to-borrowing from the bank proportion you can expect to increase. Specifically if you enjoys a giant personal credit card debt, closure the fresh account doesn’t assist your credit score but will carry it down alternatively.

Agreeing To help you Co-To remain A loan

Once you co-sign, your invest in become partially guilty of the debt the fresh borrower is likely to invest. It indicates a massive reduction on the credit score whenever they dont generate those costs punctually.

In the event that you Follow You to definitely Bank While deciding Applying for An effective Financial?

You could think easier to heed one bank and you can look whatever they like and you may what they cannot. However, this will limit one to you to lender’s formula.

Instead, proceed through various other lenders’ policies, do your homework, get the best interest you’ll and make certain to pick the deal that meets your mortgage demands the best.

Listed here is in which a professional mortgage broker is available in helpful. Home loan Experts provides fifty+ lenders with its committee, which you’ll peruse before you apply.

Your representative will ensure your apply for the financial in which you’ve got the top possibility from the winning acceptance for your home mortgage.

Should you Apply for Pre-Approval Very first?

If you’re planning so you can winnings your perfect property on an auction, you need to apply for pre-approval on the a loan earliest.

What’s the Recognition Process Having Home loan Gurus Such as for instance?

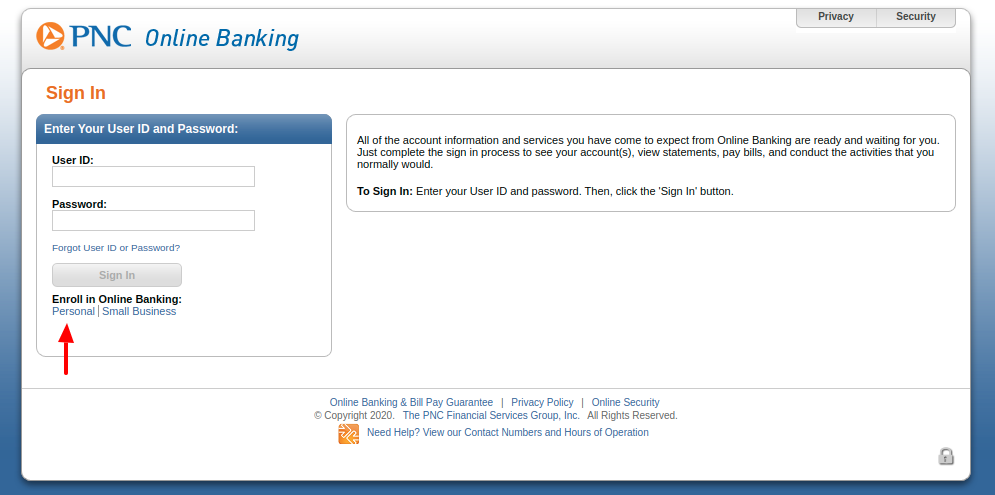

- Done and you will signal our very own short application.

- Promote proof your revenue, offers, and expense, such as for instance playing cards or other loans.

- We’re going to done an initial assessment and suggest numerous compatible lenders and you will fund.

- We’ll lodge the application with the financial you have selected.

- The financial institution tend to over a review of the situation and supply pre-recognition.

Away from hotels your own pre-recognition app to assisting you to get the best pricing, Home loan Advantages will do all of it. Discover our very own outlined page with the financial pre-recognition for much more knowledge about how precisely the procedure is other through the COVID-19 limits.

Talk to An expert

Financial Pros makes it possible to pick the proper mortgage solution and you can take a look at your home loan problem for the best you’ll result. Give us a call toward 1300 889 743 or submit the free online inquiry means.