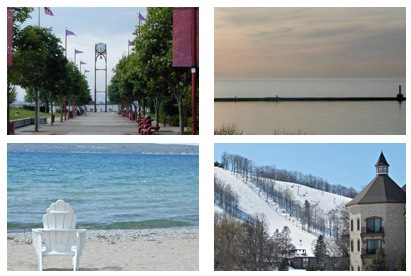

Indiana , this new Hoosier Condition, is found in this new Midwestern and you will Higher Ponds regions of the new All of us that’s known for its varied topography, together with flat plains, moving mountains, and Hoosier National Forest. It is extremely the place to find the newest Wabash River, the newest longest 100 % free-streaming lake eastern out-of Mississippi.

The state enjoys a diverse benefit, with manufacturing, farming, and you can attributes to try out tall opportunities. Indianapolis are a major heart getting fund, insurance rates, a house, professional characteristics, and you may health care.

Indiana houses multiple institutions out of advanced schooling, plus Purdue College or university and you will Indiana University. Baseball retains a different sort of input Indiana’s community, therefore the county try passionate about senior high school and college baseball. Indianapolis hosts one of the most well-known auto races throughout the business, the newest Indianapolis five-hundred.

The official has actually an abundant social traditions determined by Indigenous American, European, and you can Ebony way of living. Indiana generally have a less expensive housing marketplace compared to federal average. not, particular costs may vary according to the area, urban otherwise outlying parts, and you will local economic affairs.

The actual estate field during the Indiana has shown balance, which have reasonable prefer home based philosophy in different portion. Markets manner will be determined by activities including occupations development, populace change, and you can economic advancement. Towns such as for example Indianapolis may experience large request and you may reduced-moving enities, employment opportunities, and you will system can impact the real property figure in different places. Indiana is sometimes sensed economical than many other states. It cost are going to be appealing to each other homeowners and you will a home dealers.

The latest country’s overall monetary wellness, jobs ent is determine the genuine house business. Indiana’s varied benefit, which have strengths in manufacturing, farming, and you can qualities, can be join stability.

Indiana Home mortgages

Fantasizing off owning a home in the Indiana? Take a look at Investment Home loan! Regardless if you are purchasing your very first household, tackling a remodelling endeavor, or strengthening your own forever home from the soil right up, we possess the perfect loan and come up with your own goals a real possibility. Assist the specialist party direct you because of each step of way, regarding pre-approval so you’re able to closing, having competitive costs and you can custom services.

Buying a house inside Indiana are going to be enjoyable, not tiring! At Financing Real estate loan, the audience is serious about and also make your dream from homeownership possible. Our team from expert mortgage officers acts as a book because of each step of the techniques, bringing clear reasons and answering all your valuable issues. We shall make it easier to explore different loan selection, making certain you can see the best fit for your specific means and you may economic requirements. Which have Financial support Mortgage, you can be assured you’re in capable hand, making the go to the new domestic effortless and you can fun.

Indiana Refinance Mortgages

Need certainly to decrease your monthly mortgage repayments, shorten the loan label, otherwise dump that pesky PMI? An Indiana Price and you can Identity Refinance regarding Resource Mortgage loan you may function as address! We will make it easier to change your most recent home loan to have a shiny brand new one which have better rates, terminology, if not an alternative financing program completely. Its a simple way to save thousands of dollars over the life of the loan and you will obtain better monetary self-reliance.

Indiana Cash out Mortgage loans

Open the newest hidden prospective of the Indiana house https://paydayloancolorado.net/briggsdale/ or apartment with a money Aside Refinance! So it strong economic unit allows you to tap into the residence’s collateral and start to become they on the cash getting all you you desire from your home renovations and debt consolidation reduction to help you financing studies or searching for a dream. While rates of interest was a little greater than a classic refinance, a cash out Refinance’s independency and you will financial electricity is a good game-changer to possess residents seeking get to their desires. Let Investment Real estate loan direct you from processes that assist you availability the newest security you have worked hard to create!