Having pre-acceptance at your fingertips, veterans and you will army employees can be proceed with full confidence within research due to their fantasy home with the new assurance that they have secured financing with increased beneficial terminology than traditional mortgage loans.

Which have an idea of just how long the newest pre-acceptance processes takes is essential for these applying for a good Va mortgage. However, multiple issues make a difference to the schedule that can cause it to take more time or shorter than anticipated.

One factor you to definitely impacts the pace out-of pre-approval is how quickly this new debtor responds to needs on lender . If your debtor was sluggish inside the submission required files or answering inquiries, this may impede the method. On the other hand, in the event that you’ll find any problems or inaccuracies about information given , this may include time for you to approve good Virtual assistant mortgage pre-acceptance.

A new factor that influences pre-recognition timing is how active the lending company was at any given date . Throughout certain times, loan providers may discover much more programs than just capable deal with which can result in waits inside the handling documents and you will providing an affirmation choice. To greatly help make certain a flaccid techniques, you should run a loan provider having feel dealing which have Va loans so they are able promote short turnaround situations where requisite.

Tips for Expediting Brand new Virtual assistant Financing Pre-Acceptance Processes

To make sure a mellow pre-approval procedure, you will need to do your part. Getting hands-on and you can organized will help automate this new schedule and you will give you a better likelihood of being qualified. Here are some tips to aid expedite the fresh Va loan pre-acceptance processes:

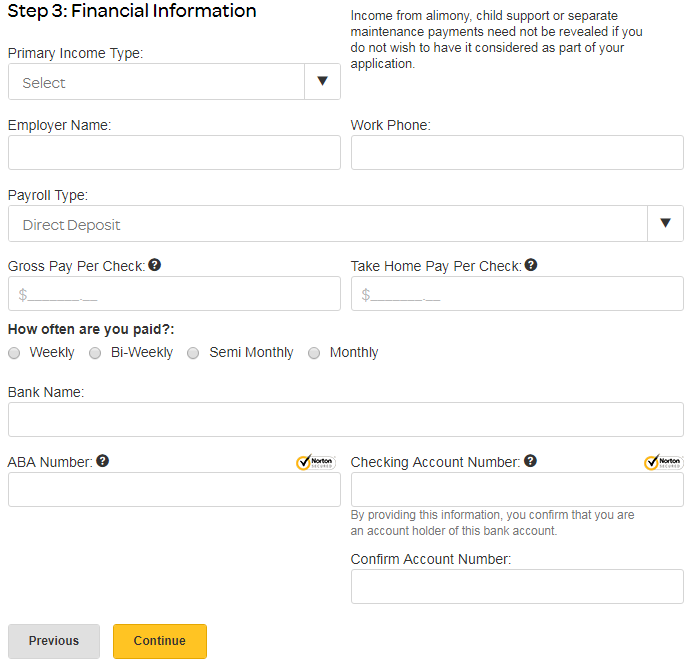

- Make certain all requisite records try attained and you can accessible to the new lender on time. This can include monetary statements, tax returns, evidence of money, family savings pointers, and every other expected files. It is also useful to double-be sure all info is particular before distribution it towards the lender.

- Getting responsive when chatting with the financial institution . It is necessary to not impede responding issues otherwise responding to needs for additional data otherwise information. More quickly your respond to its concerns, quicker you can aquire an endorsement choice throughout the bank.

Coping with an educated financial is useful in providing due to the newest pre-approval processes as soon as possible. A talented lender usually learn which data files https://paydayloanflorida.net/avon-park/ are needed initial and you can should be able to publication the entire process and that means you has a far greater chance of taking recognized within this an acceptable schedule.

Achievement

To summarize, Va financing pre-approval is an important step in the process of to acquire a great house or apartment with good Va financing. It permits loan providers to confirm your own qualification for good Va loan, in addition to regulate how much you could use. The amount of time it will take to find pre-approved getting an excellent Virtual assistant financing varies according to your unique disease as well as how prepared you are going into the procedure. It requires anywhere from you to around three days to get pre-acceptance.

So you’re able to expedite the method, individuals would be to be certain that he has all needed data files and you may advice able prior to distribution their software so as that nothing delays the new approval schedule. Having correct think and preparing, pros will be accepted for their Virtual assistant loans easily and you may with full confidence, allowing them to progress that have to find their dream property.

After accepted, you’ll receive a pre-approval letter one to traces your loan count or any other extremely important details. So it letter can be used to generate a deal for the good household your searching for to shop for that have a beneficial Va loan. Simultaneously, with pre-approval can provide a bonus more than other people that do n’t have a great pre-recognition page when making a deal on a house.